NFT: our explanations to understand everything in a few minutes

What is an NFT?

An NFT, or non-fungible token, is a unique token that certifies to its holder the ownership of a digital asset (collectible, video game item, digital artwork, etc.) or physical asset (artwork, real estate and many others).

The acronym NFT stands for non fungible token and is therefore dissociated into two terms: token and non fungible. First of all, an NFT is a token because it is issued on a blockchain, mainly Ethereum (ETH). However, it differs from other crypto-currencies in that it is non-fungible.

To understand this concept properly, it is necessary to define fungibility. An asset is fungible if :

- It is not unique;

- It is interchangeable against an asset of the same type.

The currencies we use in our daily lives are the most obvious example: Euros are fungible assets. A one-euro coin is not unique, so you will have no problem exchanging it for another one-euro coin, which has the same value.

Similarly, most crypto-currencies such as Bitcoin (BTC) or Ether (ETH) are fungible and interchangeable. Moreover, they are divisible: 1 bitcoin can be divided into up to 100 million satoshis (the smallest unit of account in bitcoin).

Conversely, Non-Fungible Tokens (NFTs) are specific in the cryptocurrency world, as they are unique, indivisible and identifiable. Thus, no two NFTs created will be exactly the same and interchangeable, each will have specific characteristics to define it, as well as an identifier of its own.

In other words, an NFT is unique because of the characteristic associated with it. In comparison, Pokémon cards can be considered NFTs because the rarest card in the collection is not as valuable as a very basic card.

The origin of NFTs

Historically, non-fungible tokens were created on the Ethereum blockchain. They were introduced in 2018 through the proposal of the ERC-721 standard, which acts as a standard for this type of token. An NFT is therefore in most cases an ERC-721 token, while a classic token follows the ERC-20 standard. There are other standards for NFT tokens, but these are reserved for very specific uses.

However, before they were clearly defined, NFTs went through a period of infancy. In 2012, colored coins were already emerging on the Bitcoin blockchain, allowing certain tokens to be recognized through the addition of a metadata overlay to associate with a physical asset.

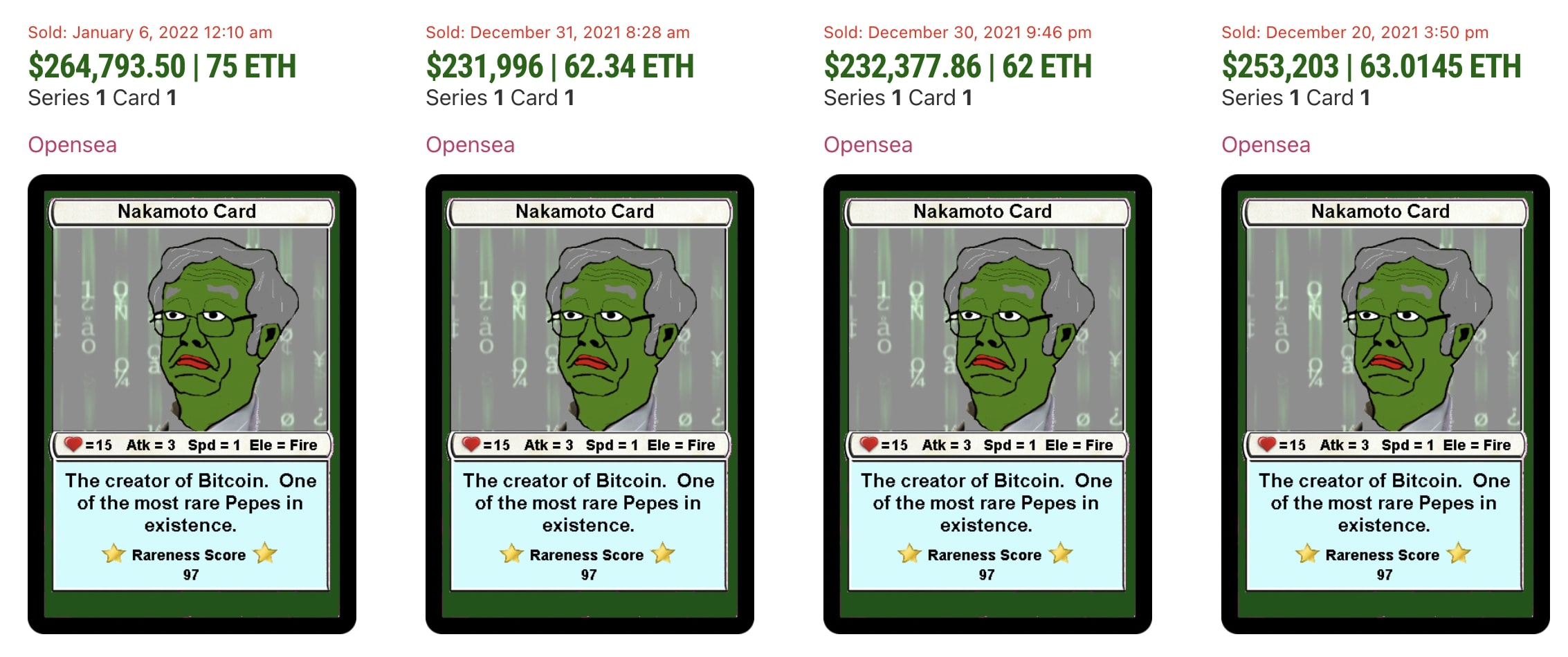

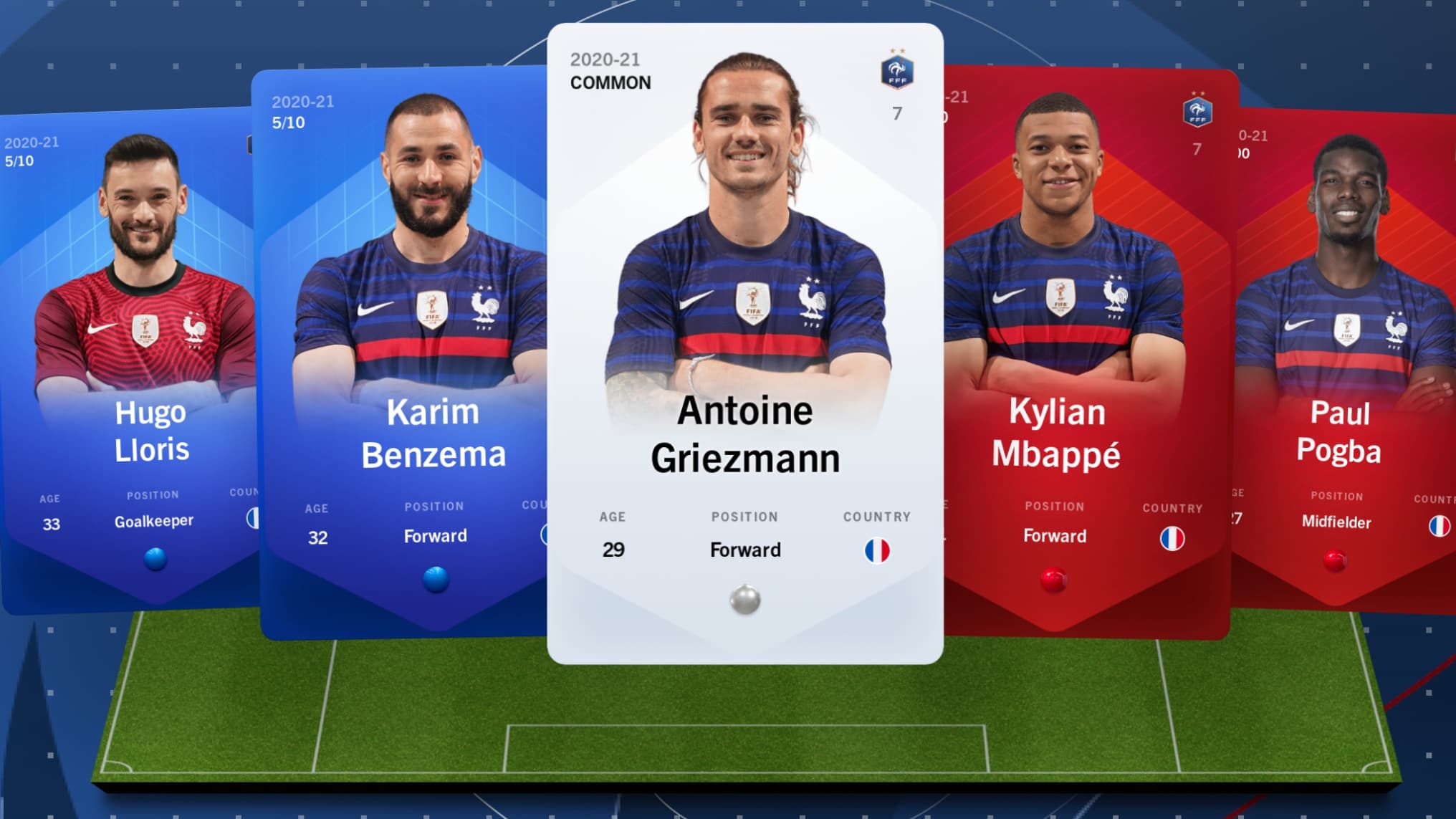

Having originated in 2016, the Bitcoin-based Rare Pepe project is a series of collectible images adapted from the character Pepe the frog that has seen significant success. It is considered by some to be the ancestor of NFT collections as we know them today.

The year 2021 was marked by the growth of the NFT market. Many collections have seen their prices explode, just like CryptoPunks or Bored Ape. Today, NFTs are no longer limited to Ethereum and have been popularized on other blockchains as well, such as Solana, Polygon, Tezos or Avalanche for example.

What are the use cases of NFTs?

We briefly touched on this, non-fungible tokens or NFTs can support a multitude of uses. They really exploded in 2021 as collectibles, but of course they are not limited to that. Here are some of the big areas where they are being used:

- The “collectibles”;

- Video games;

- Art;

- Real Estate ;

- Decentralized finance;

- And many others.

The “collectibles

Collectibles” are the collectible series of NFT. Simply put, they are collections containing a limited number of designs on a specific theme, with various attributes and rarities. Usually, collectors buy such an NFT in order to use it as a profile picture on social networks, although other uses have gradually developed.

CryptoPunks propelled the NFT market and started the collectibles trend. This collection of 10,000 pixelated characters was randomly generated by an algorithm and generated a total volume of over one million Ether (ETH).

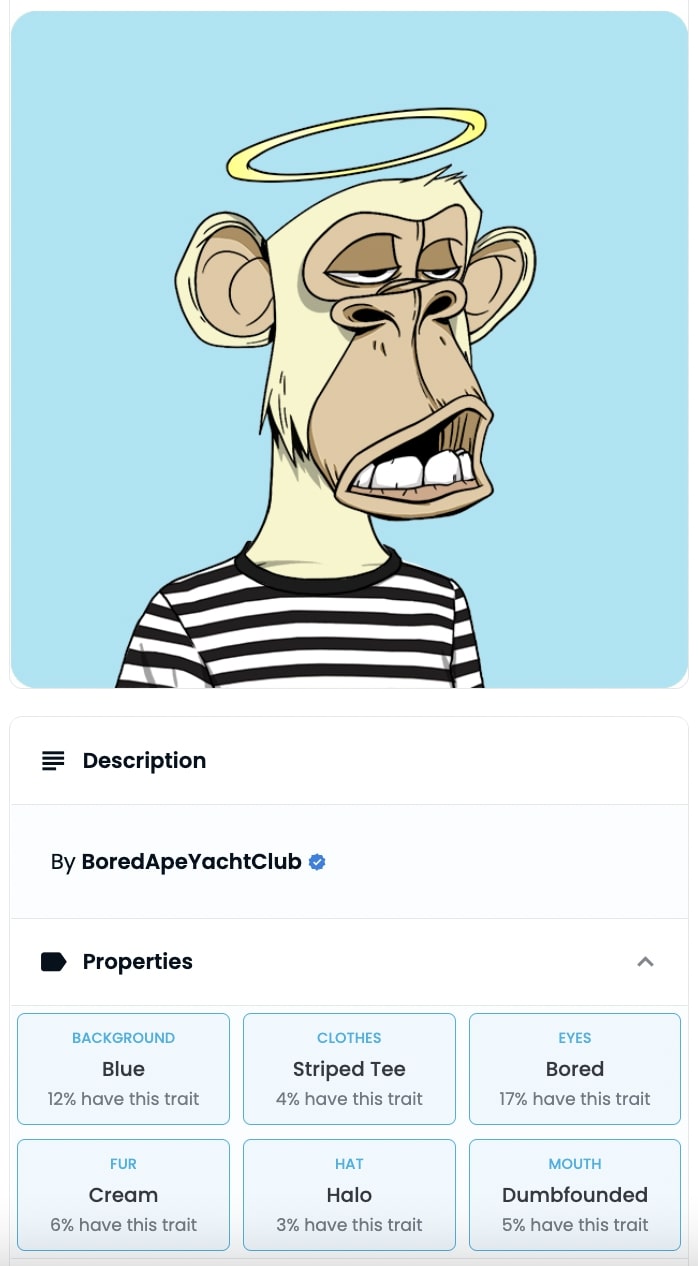

The second most famous collection is the Bored Ape Yacht Club (BAYC). Also composed of 10,000 copies, these virtual monkeys with various attributes are traded for several dozen ETH and have attracted well-known personalities such as Jimmy Fallon, Justin Bieber, or Stephen Curry.

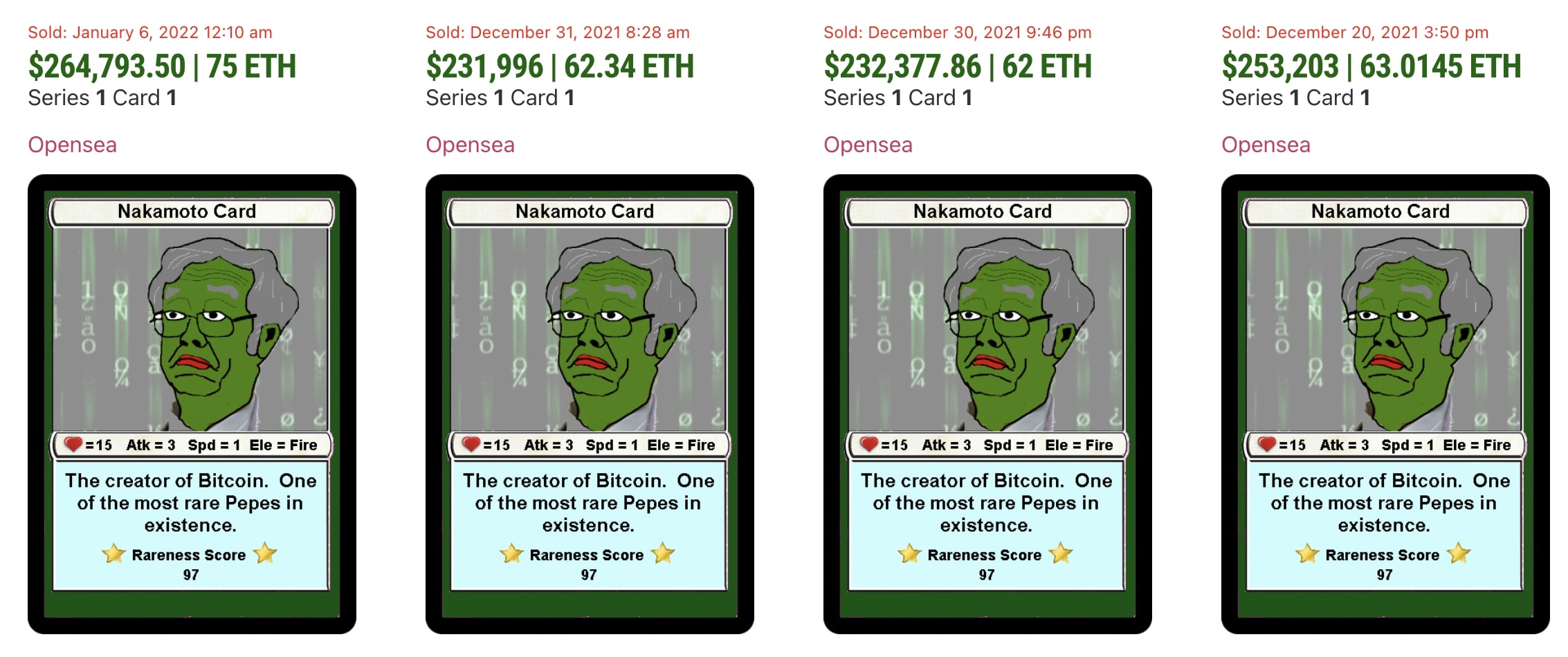

Volume distribution (in dollars) in the NFT market

In 2022, collectibles will account for approximately 60% of NFT-related trading volumes. However, this sector of the market is often criticized as the interest is currently very low and can easily amount to speculation.

NFT and video games

NFTs first attracted attention in the field of video games, especially collectible games. The “historical” game remains, of course, CryptoKitties. Launched in 2017, the decentralized Ethereum-based app allows you to collect virtual cats, much like you would collect Pokémon cards.

Other trading card games followed, in particular games inspired by Magic: The Gathering or Hearthstone. They allow you to make your cards fight and earn rewards in cryptocurrencies. One of the best known is Gods Unchained.

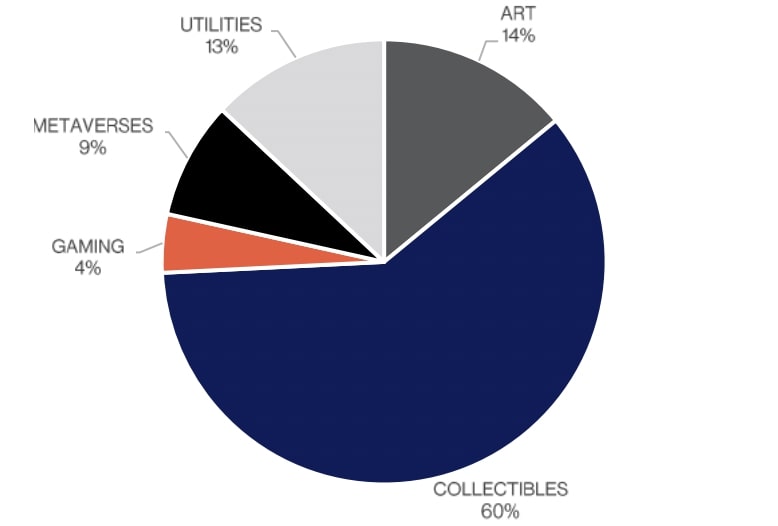

Extract from the Sorare game and the cards of the French team

NFTs are also used in a variety of games. They are sometimes created to represent equipment, such as armor or weapons, to be stored and traded freely by players. One of the main advantages of NFT in this case is that the item belongs to the player and the game publisher has no control over it, so it cannot be arbitrarily taken away from you.

One of the most well-known blockchain games to date is Sorare. The French startup uses NFT technology to create unique soccer cards. These earn points based on players’ performances in real matches and allow players to compose teams and compete against each other.

Play and collect cards in NFT format

The NFT and digital art

The first area that comes to mind when talking about NFT is art. Indeed, this technology allows to store any digital object on the blockchain: image, video, GIF, etc. However, NFT adds the dimension of a digital certificate of possession of that asset, inscribed forever in the blockchain.

Thus, many artists were able to take advantage of the trend to sell their work as digital art, and thus NFT. In March 2021, the Kings of Leon released the first NFT music album in history. Other musicians have offered career highlights in the form of non-fungible tokens, such as Eminem or the French rapper Booba.

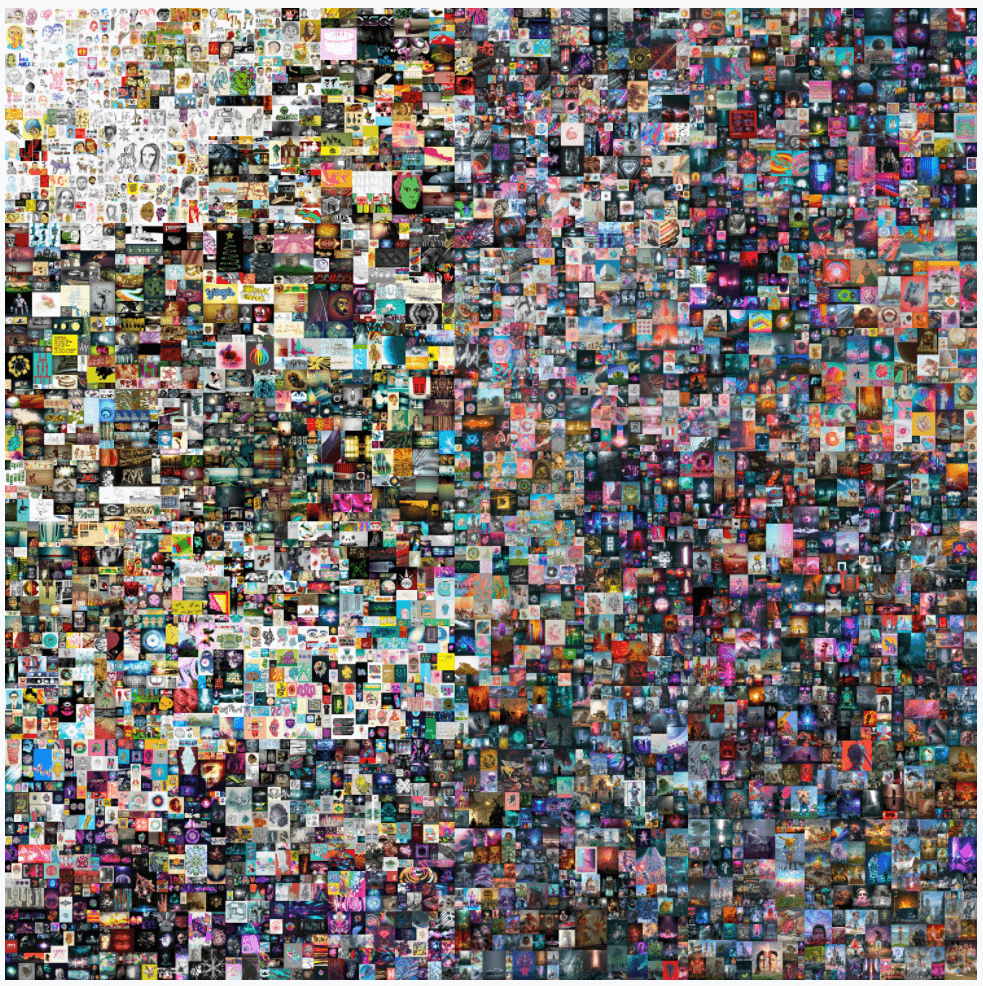

Of course, this type of token is also particularly used by digital artists. The most famous is probably Beeple’s, sold for $69 million in March 2021:

“Everyday: the First 5000 days” – Beeple’s NFT sold for $69 million

Moreover, some artists specialized in the production of digital works have been able to emerge thanks to the explosion of the NFT sector. This is notably the case of generative art via algorithms using emerging technologies such as artificial intelligence. The best known are Art Blocks or Fidenza.

It is sometimes difficult to understand the craze and the price around some NFT. However, art is an enigmatic, singular and complex world that everyone interprets in their own way. In other words, the price of a work is simply determined by what each person is willing to spend to acquire it.

NFTs and real estate

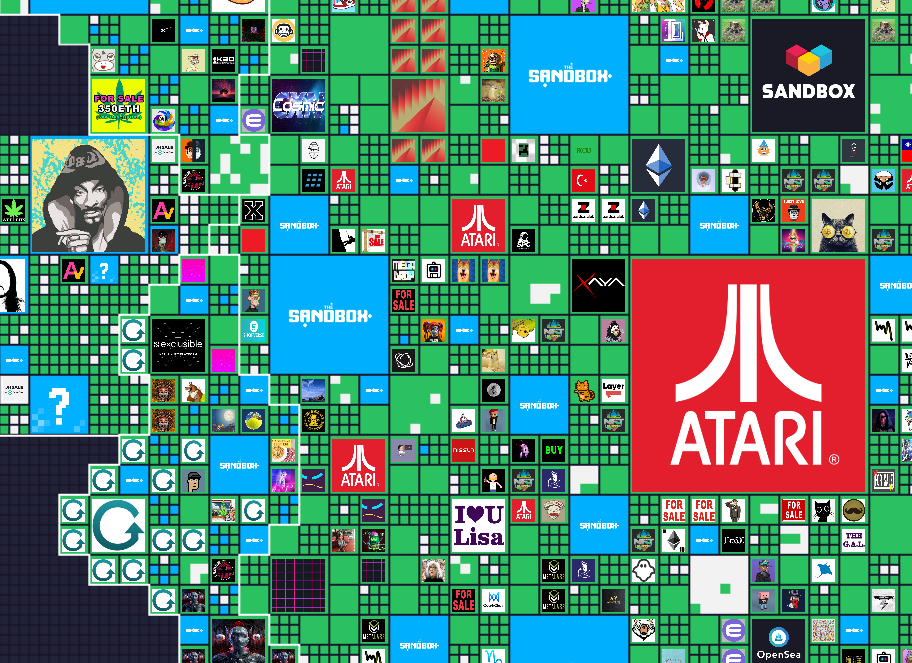

Halfway between video games and theme parks, there is also the digital real estate sector. Metaverses such as Decentraland or The Sandbox offer users 3D universes with plots. Everyone is free to buy a plot of land and then build what they want.

Extract from the map of The SandBox

Each parcel is represented by a non-fungible token, which is purchasable with a cryptocurrency. The plots vary in price depending on their attractiveness and location, just like “real” real estate. Real estate developers have even shown interest in it already.

NFTs and decentralized finance (DeFi)

The porosity between the NFT market and decentralized finance is growing. In the DeFi world, users wishing to borrow money need to deposit an asset of a certain value as collateral. Now it is possible to use an NFT as collateral.

However, the NFT market is still very illiquid and the DeFi mechanisms (loan liquidation, etc.) are therefore difficult to implement. In this sense, solutions are gradually being developed, such as the fractionalization of NFTs into several parts.

This is made possible by a new standard: the ERC-1155 standard. As with any financial asset, the shares can then be traded with each other or against other digital assets. As a result, this brings liquidity to an overly illiquid market, especially for very expensive NFTs.

Other use cases for NFTs under development

Less playfully, non-fungible tokens can also be used in the context of traceability. As NFTs are similar to certificates of authenticity and ownership of an asset, they could revolutionize many fields such as ticketing or logistics.

As early as 2019, the LVMH group had started experimenting with non-fungible tokens, in order to certify luxury goods and fight against counterfeiting. This is also the case with Balmain, whose NFTs were sold on the centralized exchange Binance.

Example of NFT from Balmain’s special collection

The blockchain also allows for the “tokenization” of a wider variety of assets. One of the most telling examples is real estate – real this time. NFTs can be used to digitize particularly illiquid assets like a house or land. When these come to the blockchain, they become much more liquid. This is a use that is very limited at the moment, but is likely to come to the fore in the coming years. One of the pioneers in this sector is RealT.

Here is an example of other use cases that could be democratized in the future thanks to NFTs:

- Intellectual property: Lens Protocol makes it possible to create decentralized social networks and to return the ownership of personal data to the users thanks to NFTs;

- Digital identity: it is possible to imagine digital identity cards in NFT ;

- Financial vehicles: NFTs can contain assets, liabilities, positions, etc. ;

- Ticketing: a ticket or entry ticket to an event can be replaced by an NFT to limit fraud;

- Logistics: Carrefour has used NFTs to set up a traceability system from producer to retailer;

- Voting: to avoid electoral fraud, a right to vote could be symbolized by an NFT.

The operation of the NFTs

Metadata

The particularity of a non-fungible token is the data it is assigned. These are called metadata and can be videos, images, text, etc. The metadata is stored in a smart contract, implemented directly in the blockchain.

In the case of a series of collectibles like the Bored Ape, the metadata includes the image as well as the different properties. For the example, these are the background color, the type of clothing, the eyes, the fur, the hat and the mouth and are displayed on the marketplace like this:

Examples of metadata for a Bored Ape

Where is an NFT stored?

As explained above, an NFT is issued on a blockchain and associated with an address or wallet. This can be the Ethereum blockchain, Bitcoin, Polygon, Solana or Avalanche for example.

As for metadata, it can be stored in different ways: on-chain or off-chain. That is, it is possible to store the image of an NFT directly in a smart contract on the blockchain. However, this costs a lot of money.

Thus the majority of projects that create NFTs store this metadata off-chain, i.e. on servers that are mostly centralized. Thus, if this one fails, the NFT will no longer have an associated image and will be only a series of numbers.

However, there are some alternatives of decentralized servers such as IPFS or Arweave, the latter being used for the storage of Instagram NFT.

How to create an NFT?

Many services now make it possible to create NFTs free of charge and without the need for extensive knowledge. Moreover, marketplaces such as OpenSea or MagicEden offer to take care of the whole process, from the creation of the smart contract to the management of the “mint”.

The creation is not necessarily very complex, we explain in our dedicated article how to create an NFT.

Where to buy NFTs?

Many platforms allow the purchase of non-fungible tokens. Just like cryptocurrency exchanges, they can be centralized or decentralized. Here is a non-exhaustive list of the main NFT marketplaces:

- OpenSea;

- Magic Eden;

- LooksRare

- Rarible ;

- Crypto.com NFT;

- Binance NFT.

It is important to note that each of these marketplaces allows the purchase of NFTs on particular blockchains. However, these are becoming increasingly multi-chain, like OpenSea and Magic Eden which support both Ethereum and Solana blockchain non-fungible tokens.

The benefits of NFTs

- An NFT belongs totally to its owner, no one can take it away;

- Facilitates the exchange and shipment of many things: works of art, proof of possession ;

- Could revolutionize many sectors such as art or real estate;

- Market in full expansion and structuring: there is therefore a lot of opportunity.

The risks of NFTs

- The market is young and promising, but mostly represented by NFT collections whose future is not certain;

- As with any innovation, many scams are present and one must be vigilant;

- The only price indicator, the floor price (the lowest NFT in the collection), is often very volatile;

- The NFT market is quite illiquid, so you may never sell your NFT if no one is willing to buy it from you;

- The problem of copyrights: artists’ works can sometimes be stolen and reused;

- Wash-trading: a number of people trade NFTs with each other to inflate their prices.

FAQ on NFT non-fungible tokens

What does NFT mean?

NFT stands for Non Fungible Token.

How to create an NFT?

An NFT can be created on specialized platforms like OpenSea or Magic Eden. You will need to provide an image, music, GIF or video to associate with your NFT and pay a fee to make it available (mint) on the blockchain.

What does “mint” an NFT mean?

In the literal sense of the word, “minting” an NFT means “minting” an NFT. Simply put, it means creating it and registering it in the blockchain to make it available for purchase, exchange and resale.

How much does an NFT cost?

Some creators offer to mint (get) their NFT for free, you just have to pay the network fee to mint the NFT.

How to get a free NFT?

Some creators offer to mint (get) their NFT for free, you just have to pay the network fee to mint the NFT.

Why do NFTs increase in value?

The value of an NFT depends on supply and demand. For an NFT, its rarity, unique characteristics or usefulness, and the willingness of buyers to purchase it will vary its price. When an NFT is listed on an exchange platform, the creator will often list all the information he wants to present to his audience such as the number of copies available, the characteristics or the usefulness of an NFT.

What is the purpose of purchasing NFTs?

It all depends on the NFT in question. Generally speaking, the issuer of an NFT offers benefits to its holder, which can range from access to private groups, exclusivities, premium content, etc. It is necessary to find out what the NFT is for before buying it directly from the project’s website.